oklahoma inheritance tax rate

Many people are allowed to leave a further. This is what is called Portability.

02 Governor Lee Cruce 1911 To 1915 Oklahoma Governors Oklahoma Digital Prairie Documents Images And Information

This helped provide clarity for Oklahoma estate planning.

. Postic is an attorney at Postic Bates PC. Estate tax of 08 percent to 16 percent on estates above 17 million. Getting Help from An Oklahoma City Tax Planning Lawyer.

As of 2021 the six states that charge an inheritance tax are. Nebraska has the highest top inheritance tax rate 18 percent thats charged to nonrelative heirs. The top estate tax rate is 16 percent exemption threshold.

No estate tax or inheritance tax. Inheritance tax rates differ by the state. 2 days agoThe current nil-rate band sits at 325000 per individual and means that anything over this amount will be taxed at a rate of 40 percent.

Now the IRS Estate Tax Exemption and IRS Gift Tax Exclusion are updated annually. Compare the best tax software of 2022. Iowa Kentucky Nebraska New Jersey and Pennsylvania are the states that do have the local inheritance tax.

Get a FREE consultation. Inheritance tax of up to 15 percent. An individuals tax liability varies according to his or her tax bracket.

The 2018 Tax Reform Act has increased the estate tax exemption for 2018 to 112 million per person or 224 for a married couple. Note that historical rates and tax laws may differ. Children however are charged a 1 percent tax rate while nephews and nieces get taxed at 13 percent.

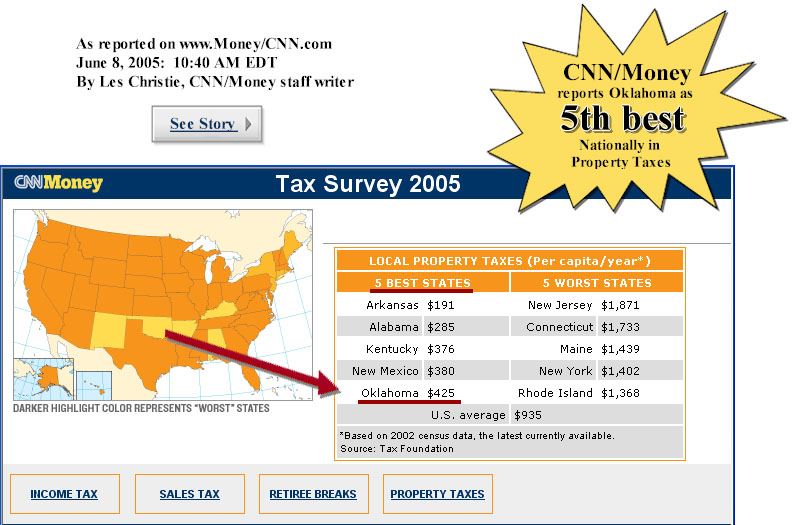

Key findings A federal estate tax ranging from 18 to 40. With proper estate planning a wealthy couple can. The personal income tax rates in Oklahoma for the 2015 tax year ranged from 050 percent to 525 percent.

A tax bracket is the income range to which a tax rate applies. Keep reading for all the most recent estate and inheritance tax rates by state. His practice focuses on estate planning probate real estate trust administration business planning and adoption.

The top estate tax rate is 16 percent exemption threshold. Tax rates Personal income tax See also. 6 rows State inheritance tax rates range from 1 up to 16.

No inheritance tax is paid if. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption There is no inheritance tax or estate tax in Oklahoma. Although there is no inheritance tax in Oklahoma you must consider whether your estate is large enough to require the filing of a federal estate tax return Form 706.

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million. Estate tax of 16 percent on estates above 5 million. Estate tax of 10 percent to 16 percent on estates above 1 million.

Although there is no inheritance tax in oklahoma you must consider whether your estate is large enough to require the filing of a federal estate tax return form 706. No estate tax or inheritance tax. 7 hours agoInheritance tax of 40 per cent is typically levied on a deceased persons assets worth over and above 325000 which is called the nil rate band.

In Oklahoma there are seven income tax. Inheritance tax usually applies when. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island.

The top inheritance tax rate is 15 percent no exemption threshold rhode island. Estate tax of 10 percent to 20 percent on estates above 22 million. You can email David through our Contact.

Oklahoma Child Custody Forms Fill Out And Sign Printable Pdf Template Signnow

Oklahoma Real Estate Forms Lexisnexis Store

Inheritance Tax Here S Who Pays And In Which States Bankrate

Downtown Oklahoma City Assessor Of Oklahoma County Government

Chris Frizzell Owner F F Accounting And Tax Linkedin

Form 13 34 Download Fillable Pdf Or Fill Online Application For Registration Of Aircraft And Report Of Excise Tax For Aircraft Purchased On Or After November 1 2017 Oklahoma Templateroller

Form 13 34 Download Fillable Pdf Or Fill Online Application For Registration Of Aircraft And Report Of Excise Tax For Aircraft Purchased On Or After November 1 2017 Oklahoma Templateroller

Downtown Oklahoma City Assessor Of Oklahoma County Government

Regressive Features Of The Tax System Oklahoma Policy Institute

These Are The 10 Best Neighborhoods In Chicago To Live In Chicago Neighborhoods Best Places To Retire Chicago